NBFC FORMATION

Non-Banking Financial Company (NBFC)

An NBFC is a company registered under the Companies Act, 2013 and it must have a minimum of Rs. 2 Crores of Net owned funds.

NBFC is a financial institution that doesn’t have a banking license but can offer financial products and services to customers. NBFC is primarily concerned with loans and advances, hire-purchase, finance leasing, acquisition of shares, chit fund, etc. NBFC is different from a bank due to NBFC cannot accept demand deposits, cannot issue a cheque drawn on itself, and NBFC depositors do not get deposit insurance and credit guarantee coverage.

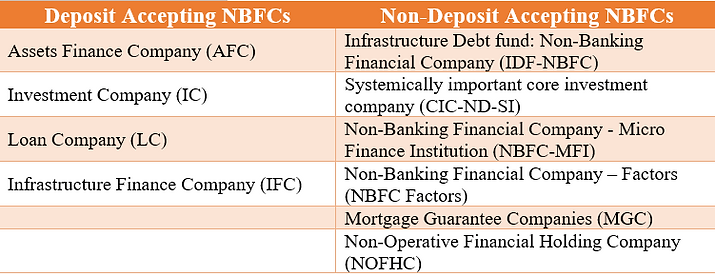

Different Types of NBFCs:

.png)

Registration Process of NBFC

The applicant company is required to apply online and submit a physical copy of the application along with the necessary documents to the Regional Office of the Reserve Bank of India.

The application can be submitted online by accessing RBI’s secured website https://cosmos.rbi.org.in.

The company can fill in an application form and submit the application form along with the required documents.

The company would then get a Company Application Reference Number (CARN) for the application filed online.

Thereafter, the company has to submit the hard copy of the application form (indicating the online CARN, along with the supporting documents, to the concerned Regional Office.

The company can then check the status of the application from the above mentioned secure address, by keying in the acknowledgment number.

Documents required for NBFC Registration

-

Certified copy of Certificate of Incorporation

-

Details of change in the management of the company during last financial year till date if any and reasons thereof.

-

A copy of PAN or Corporate Identity Number (CIN) of the company

-

Documents related to the office location/address

-

Certified copy of the up-to-date Articles of Association (AOA) and Memorandum of Association (MOA)

-

Details of clauses in the memorandum relating to financial business.

-

Details of changes in the Memorandum and Articles of Association duly certified.

-

List of Directors’ profiles must be duly signed by each director and must be attached

-

Certificate from the respective NBFC/s where the Directors have gained NBFC experience.

-

Copy of PAN and DIN allotted to the Directors.

-

CIBIL Data pertaining to Directors of the company

-

A copy of a board resolution that certifies that a company has not carried out or stopped NBFC activity and will not carry until the registration from RBI is granted

-

A board resolution on the ‘Fair Practices Code’ is to be passed, and the certified copy of the same is to be submitted.

-

Certificate issued by the statutory auditor stating that the company is not holding the public deposit and does not accept it as well.

-

Certificate specifying owned funds as on the date of an application from the Statutory Auditor is required.

-

information regarding the bank account, loans, balances, credits, etc. is to be furnished.

-

If applicable, an audited balance sheet and profit and loss statement along with the director’s and auditor’s reports of the preceding three years have to be submitted.

-

A self-certified copy of a bank statement and Income Tax Returns are required.

-

Information detailing a company’s future plan, generally for the next three years, and the projection of balance sheets, cash flow statements, and income statements.

Note: The above list is indicative and not exhaustive. Banks can, if necessary, call for any further documents to satisfy themselves on the eligibility for obtaining registration as NBFC.