INCOME TAX COMPLIANCE

Income Tax Services

Income earned in a financial year a part of which is taxable as per the rates prescribed for that year. A financial year means a period of one year from 1st April to 31st March.

Sources / Heads of Income

-

Income from Salary: It includes such income which is received in form of wages, salary, bonus, perquisites, gratuity, annuity, Fees, commission, profits in lieu of or in addition to salary

-

Income from House Property: Income received or receivable from any household property that contains rent from the usage of residential/commercial properties.

-

Income from Business or Profession: any income is shown in the profit and loss account after taking into account all the allowed expenditures by an Assessee.

-

Income from Capital Gain: Any Income that is received through the sale of a capital asset. It can be of Long-term Capital Gain (LTCG) and Short-term Capital Gain (STCG).

-

Income from Other Sources: Any income remains that does not come under the above-mentioned heads will be counted as income from other sources like interest income.

Tax Rates for FY 2024-25 and FY 2025-26 :

Individuals, HUF, AOP

-

Enhanced rebate: If income is up to ₹12 lakhs, effective tax payable is NIL due to increased Section 87A rebate of ₹60,000. Does not apply for special income such as capital gains, crypto, gaming, etc.

Senior Citizens & Super Senior Citizens (Residents, FY 2024-25 & 2025-26)

-

Section 87A rebate: Up to ₹5 lakh, full rebate available.

Tax Slabs under New Regime

- The new tax regime does NOT provide additional benefits for seniors; same slabs apply as for all individuals.

Special Benefits for Seniors (Old Regime)

-

Paper filing option for ITR for super senior citizens (Form 1 or Form 4).

-

No advance tax liability (if no business/profession income).

-

Section 80TTB: Deduction up to ₹50,000 on interest from bank/post office deposits.

-

Section 80D: Medical insurance premium deduction up to ₹50,000.

-

Section 80DDB: Deduction up to ₹1,00,000 for certain diseases treatment.

-

Higher TDS threshold (₹50,000 interest per bank before TDS applies).

Non - Resident Individuals (FY 2024-25 & 2025-26)

Who qualifies?

Not resident in India as per Section 6 of Income Tax Act (based on days spent and income tests)

Tax Slabs (Old Regime)

-

No enhanced exemption for age.

-

Section 87A rebate not available to NRIs.

-

Surcharge and health/education cess applicable based on total income.

Tax Slabs (New Regime)

-

Same as for residents, but NRIs cannot claim some deductions/rebates, and Section 87A rebate is not available.

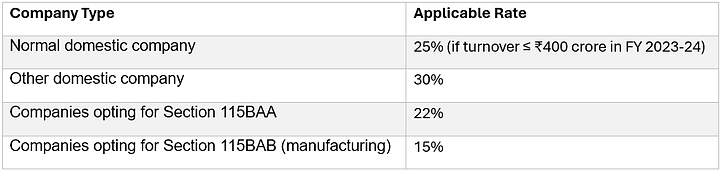

Domestic Companies Tax Rates

-

Surcharge (on tax):

-

7% if total income > ₹1 crore and ≤ ₹10 crore

-

12% if total income > ₹10 crore

-

-

Health & Education Cess: 4% (on tax + surcharge)

-

Minimum Alternate Tax (MAT): 15% of book profits (if not opting for the special sections)

Foreign Companies Tax Rates

-

Surcharge:

-

2% if income > ₹1 crore and ≤ ₹10 crore

-

5% if income > ₹10 crore

-

-

Health & Education Cess: 4% (on tax + surcharge)

Example: Effective Rate for Domestic Companies

Notes:

-

Special reduced rates (115BAA/115BAB) require companies to opt for the regime and forego certain deductions.

-

Dividend income is subject to max surcharge 15%.

All rates above are exclusive of surcharge and cess; final liability is always increased by these add-ons.

If you need sector-specific rates, MAT/SAM implications, or a breakdown for LLPs or partnerships, connect with us